Contactless payments: The future of payments

In the dynamic scenery of digital transactions, contactless payments represent not just a trend but a transformative leap in how we engage with our finances. As we delve into the future, fueled by innovative payment solutions, the shift towards contactless payments is reshaping the way we conduct transactions.

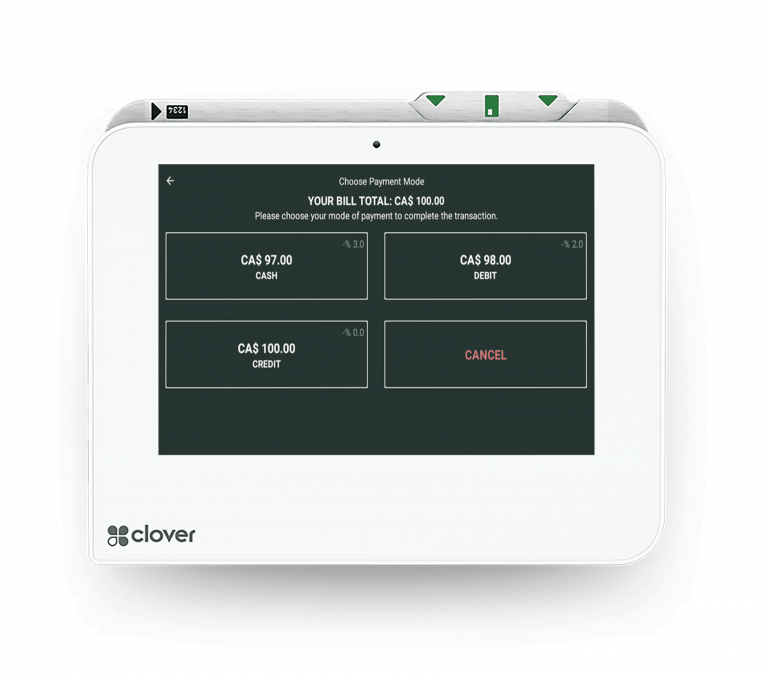

-

The Rise of tap-and-go:

Unveiling unparalleled simplicity, contactless payments, epitomized by the ubiquitous tap-and-go method, have witnessed exponential growth. Consumers are drawn to the ease of waving their card or mobile device to complete a transaction swiftly. -

Accelerated adoption post-pandemic:

The global health crisis acted as a catalyst, expediting the adoption of contactless payments. The desire for a touch-free experience in retail environments fueled a surge in usage. Now, more people recognize the hygiene and efficiency benefits.

-

Diverse ecosystem of devices:

Extending beyond cards, proximity payments have diversified the ecosystem. With the integration of mobile wallets and wearable devices, such as smartphones, smartwatches, and even fitness trackers, users now enjoy flexibility and choice. -

Enhanced security measures:

Addressing security concerns, advanced encryption and authentication protocols accompany contactless payments. Multiple layers of security safeguard sensitive financial information, making them as secure as traditional payment methods, if not more. -

IoT and contactless integration:

The Internet of Things (IoT) plays a pivotal role in the evolution of touch-free payments. Connected devices in smart homes and connected cars seamlessly integrate payment capabilities, paving the way for a more connected and efficient lifestyle. -

Environmental impact:

Going beyond convenience, contactless payments contribute to a more sustainable future. By reducing the need for paper receipts and physical currency, this aligns with the global push towards eco-friendly practices.